RECENTLY FUNDED 1031 PROGRAMS

1031 DST Investments

Request Current DST and TIC Exchange Property List

Senior Living

DST

FULLY FUNDED

Washington

Investment Type: Senior Living and Memory Care

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4%

Fully Syndicated Value: $45,210,600

Equity Remaining: Fully Funded

Loan Amount: $26,350,000

Hold Period: 7 year

Total Equity/Beneficial Interests: $18,860,000

LTV: 58.3%

Occupancy: Varies

Minimum purchase 1031: $100,000; Accredited

Multi-Family

DST

FULLY FUNDED

Class A garden style multifamily property.

Prattville, Alabama

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4%

Fully Syndicated Value: $43,925,000

Equity Remaining: Fully Funded

Loan Amount: $24,375,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $15,673,000

LTV: 55.49%

Occupancy: 91.25%

Minimum purchase 1031: $100,000; Accredited

Multi-Family

DST

FULLY FUNDED

Sarasota, Florida

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4%

Fully Syndicated Value: $88,100,000

Equity Remaining: Fully Funded

Loan Amount: $42,625,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $45,475,000

LTV: 48.38%

Occupancy: 95%

Minimum purchase 1031: $100,000; Accredited

Industrial

DST

FULLY FUNDED

New Albany, OH

Investment Type: Net Lease Commercial

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4.7%

Fully Syndicated Value: $23,565,000

Equity Remaining: Fully Funded

Loan Amount: $13,650,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $98,479,389

LTV: 57.9%

Occupancy: 100%

Minimum purchase 1031: $100,000; Accredited

Hospitality

DST

FULLY FUNDED

St. Louis, Missouri

Investment Type: Hospitality

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4.3%

Fully Syndicated Value: $49,346,196

Equity Remaining: Fully Funded

Loan Amount: $22,400,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $26,946,196

LTV: 45.39%

Occupancy: Varies

Minimum purchase 1031: $100,000; Accredited

Student Housing

DST

FULLY FUNDED

197 unit student housing property located on 11.23 acres. Walking distance of Iowa State University.

Investment Type: Student Housing

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4.4%

Fully Syndicated Value: $44,010,000

Equity Remaining: Fully Funded

Loan Amount: $25,220,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $115,374,057

LTV: 57.95%

Occupancy: 99%

Minimum purchase 1031: $100,000; Accredited

Request Current DST and TIC Exchange Property List

1031 Exchange Recently Funded Programs

1031 DST Properties

Multi-Family Portfolio

DST

FULLY FUNDED

997 units of multifamily located throughout the Denver metropolitan area.

Denver, Colorado

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4.15%

Fully Syndicated Value: $239,373,307

Equity Remaining: Fully Funded

Loan Amount: $123,999,250

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $115,374,057

LTV: 51.80%

Occupancy: 94.5%

Minimum purchase 1031: $100,000; Accredited

Multi-Family Portfolio

DST

FULLY FUNDED

Three multifamily properties, 874 total units.

North Carolina, Minnesota, & Connecticut

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4.00%

Fully Syndicated Value: $218,042,339

Equity Remaining: Fully Funded

Loan Amount: $117,425,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $100,617,339

LTV: 53.85%

Occupancy: 93.9% As of 1/9/2018

Minimum purchase 1031: $100,000; Accredited

Net Lease Portfolio

DST

FULLY FUNDED

Single tenant net lease portfolio containing four tenants on long term leases that are geographically diverse.

Investment Type: Retail

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4.25%

Fully Syndicated Value: $20,485,000

Equity Remaining: Fully Funded

Loan Amount: $0

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $20,485,000

LTV: 0%

Occupancy: 100%

Minimum purchase 1031: $100,000; Accredited

Energy Royalty

1031 Program

FULLY FUNDED

Investment Type: Energy Royalty

First year projected lease payment as percentage of invested capital

(Cash on Cash): 9%

Fully Syndicated Value: $11,300,000

Equity Remaining: Fully Funded

Loan Amount: No Loan – All Cash

Hold Period: 5-8 year

Total Equity/Beneficial Interests: $11,300,000

LTV: NA

Occupancy: NA

Minimum purchase 1031: $100,000; Accredited

Chicago-Area Retail Portfolio

DST

FULLY FUNDED

Three net lease grocery properties located in Chicago MSA; with a cash-out option.

Investment Type: Retail

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4.75%

Fully Syndicated Value: $39,769,696

Equity Remaining: Fully Funded

Loan Amount: $0 (before cash-out)

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $39,769,696 (before cash-out)

LTV: 0% (before cash-out)

Occupancy: 100%

Minimum purchase 1031: $100,000; Accredited

Healthcare Portfolio

DST

FULLY FUNDED

Four properties with five separate tenants in growing metropolitan areas.

Investment Type: Healthcare

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4.20%

Fully Syndicated Value: $39,990,338

Equity Remaining: Fully Funded

Loan Amount: $0

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $39,990,338

LTV: NA

Occupancy: 100%

Minimum purchase 1031: $100,000; Accredited

Request Current DST and TIC Exchange Property List

1031 Exchange Recently Funded Programs

Investments

Multi-Family

DST

FULLY FUNDED

A 228-unit multifamily garden style apartment community located on approximately 13.18 acres.

Olathe, Kansas

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 5.30%

Fully Syndicated Value: $44,187,000

Equity Remaining: Fully Funded

Loan Amount: $24,862,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $19,325,000

LTV: 56.27%

Occupancy: 98%

Minimum purchase 1031: $100,000; Accredited

Multi-Family

DST

FULLY FUNDED

Class A apartment community

consisting of 232 units.

Sandy Springs, Georgia

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 5.30%

Fully Syndicated Value: $52,397,488

Equity Remaining: Fully Funded

Loan Amount: $27,150,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $24,742,538

LTV: 51.82%

Occupancy: 96%

Minimum purchase 1031: $100,000; Accredited

Office

DST

FULLY FUNDED

Net lease office property.

Near Boston, Massachusetts

Investment Type: Office Property

First year projected lease payment as percentage of invested capital

(Cash on Cash): 5.8%

Fully Syndicated Value: $41,200,000

Equity Remaining: Fully Funded

Loan Amount: $25,527,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $15,673,000

LTV: 62%

Occupancy: 100%

Minimum purchase 1031: $100,000; Accredited

Multi-Family

DST

FULLY FUNDED

260 unit multifamily property built in 2014.

Colorado Springs, Colorado

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 4.75%

Fully Syndicated Value: $64,974,578

Equity Remaining: Fully Funded

Loan Amount: $36,000,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $28,974,578

LTV: 55.41%

Occupancy: 91.2%

Minimum purchase 1031: $100,000; Accredited

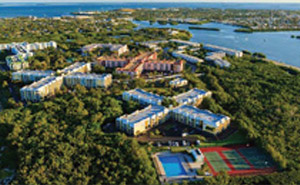

Multi-Family

DST

FULLY FUNDED

A 297 unit, multi-family community on 17.11 acres.

Key West, Florida

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 5.45%

Fully Syndicated Value: $116,275,000

Equity Remaining: Fully Funded

Loan Amount: $65,975,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $50,300,000

LTV: 56.74%

Occupancy: 91%

Minimum purchase 1031: $100,000; Accredited

Multi-Family

DST

FULLY FUNDED

320-unit Class A Multifamily property built in 2016. Approximately 16 acres, diverse mix of studio, 1 and 2-bedroom units.

Savannah, Georgia

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 5.20%

Fully Syndicated Value: $71,490,000

Equity Remaining: Fully Funded

Loan Amount: $5,000,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $30,800,000

LTV: 56.92%

Occupancy: 91.25% as of 12/27/2017

Minimum purchase 1031: $100,000; Accredited

Request Current DST and TIC Exchange Property List

1031 Exchange Recently Funded Programs

1031 DST Investments

Office

DST

FULLY FUNDED

Zero cashflow investment to suit investors in need of high leverage.

Chicago

Investment Type: Office

First year projected lease payment as percentage of invested capital

(Cash on Cash): 0%

Fully Syndicated Value: $398,276,589

Equity Remaining: Fully Funded

Loan Amount: $332,942,584

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $65,334,005

LTV: 83.36%

Occupancy: 100%

Minimum purchase 1031: $100,000; Accredited

Healthcare

DST

FULLY FUNDED

Two one-story medical office buildings.

Utah and Idaho

Investment Type: Medical Office

First year projected lease payment as percentage of invested capital

(Cash on Cash): 5.66%

Fully Syndicated Value: $12,890,000

Equity Remaining: Fully Funded

Loan Amount: $7,880,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $4,453,890

LTV: 0%

Occupancy: 100% (Average)

Minimum purchase 1031: $100,000; Accredited

Self-Storage

DST

FULLY FUNDED

Self-storage portfolio consisting of four properties, 2,282 storage units.

Alabama and Georgia

Investment Type: Self-Storage

First year projected lease payment as percentage of invested capital

(Cash on Cash): 5.25%

Fully Syndicated Value: $34,710,801

Equity Remaining: Fully Funded

Loan Amount: $18,222,000

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $16,488,801

LTV: 52.50%

Occupancy: 90.44%

Minimum purchase 1031: $100,000; Accredited

Multi-Family Portfolio

DST

FULLY FUNDED

Three apartment communities located in three different cities in the state of Colorado. Two are Class A newer builds and one has a value add opportunity.

Colorado

Investment Type: Multi-Family

First year projected lease payment as percentage of invested capital

(Cash on Cash): 5%

Fully Syndicated Value: $186,080,998

Equity Remaining: Fully Funded

Loan Amount: $94,708,913

Hold Period: 7-10 year

Total Equity/Beneficial Interests: $91,372,086

LTV: 50.90%

Occupancy: 94.7-95.5%

Minimum purchase 1031: $100,000; Accredited

Request Current DST and TIC Exchange Property List

Request Current DST and TIC Exchange Property List

To Receive a Listing of 1031 Exchange Replacement Properties Please Fill Out This Form

"*" indicates required fields

1031 Exchange Investments

Learn more about how Corcapa 1031 Advisors and its team members can help with your investment goals and create opportunities, creatively finding solutions tailored to your needs.